Pourquoi les polices globales sont-elles en échec ?

Le courtier Ukrainien d’UNIBA Partners nous livre son analyse sur les programmes d’assurance internationaux, dans le contexte actuel : Assurances ...

Employee benefits in France are comprised of French social security benefits and complementary plans taken out by companies for their employees.

The state social security coverage protects citizens against the consequences of events qualified as “social risks”. It aims to be universal and equitable. Therefore it is compulsory for all residents regardless of their :

The social security scheme is mandatory for the majority of private sector employees. It provides benefits such as Healthcare and sickness, including medical expenses, maternity, survivors’ pensions and allowances, and death grants.

Often referred to as “Complémentaire santé” or “Mutuelle”. It has been mandatory for employers, since 2016, to provide supplementary private health insurance for all employees.

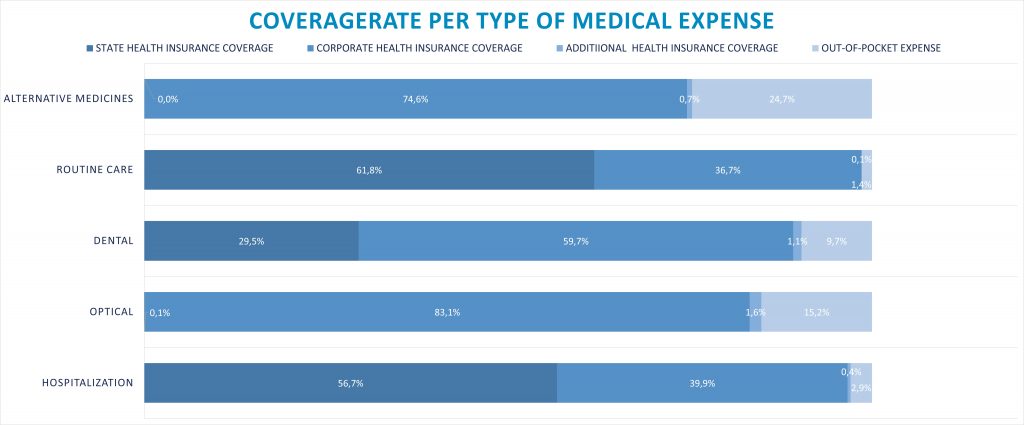

Social security covers part of health care expenses. Depending on the geographical location, the healthcare expense borne by the insured may be high (optical, dental). The company’s insurance policy aims to cover all or part of these expenses, with a minimum and a maximum set by the law.

It takes three months to become eligible for French social security.

Bilateral social security conventions (also know as bilateral agreements) aim to coordinate the laws of two states or territories in order to ensure the continuity of social protection rights for people in mobility situations.

Often referred to as « Prévoyance », these risks are usually insured within the same insurance policy.

Standard market practices :

Lump sum payment on average 3 years of salary

Annuity spouse : life annuity

Children : annuity until the end of their studies

Social security 50% of the salary (coverage from the social security) limited to the social security cap and 100% of the salary covered by the corporate policy.